tv Squawk on the Street CNBC January 8, 2013 9:00am-12:00pm EST

9:00 am

let's get back to our guest hosts for the last word. gentlemen, we're very short on time. a quick wrap-up. we just heard what jim cramer had to say about cutting spending to get back to growth. >> absolutely. >> it's the size of the government. it's intrusion in our lives that's the problem here. we don't talk enough about it, the victims of this policy. it's all savers, particularly seniors, it is our children and grandchildren. what we're doing to them is utterly immoral. we've got to come to grips with that. >> senator, what are you going to do for the debt ceiling? is there a plan that gets us -- it's not going to be a grand plan. >> as a matter of fact, yes. the cbo has got a big thick book, and it shows $4.9 trillion of ways we can reduce spending. it's a menu. >> but you don't think we'll be doing that. are you going to vote for -- >> we'll do dollar for dollar, whether $100 billion to increase the debt ceiling, $200 billion.

9:01 am

take your pick, mr. president. >> thank you four a great two hours. "squawk on the street" begins right now. congratulations to the alabama crimson tide, winners of the bcs college football championship for a second straight year. a third time in the last four years. what a run. it good morning, welcome to "squawk on the street." i'm melissa lee, live from the new york stock exchange. let's see how we're setting up on this tuesday morning. the futures look like we're tulg back here. t take a look at the picture. interesting economic data points out over there. eurozone hitting a record high. but a measure of consumer and business sentiment actually rose for the second straight month in the month of december. a road map this morning starts in china, where young brand said

9:02 am

same-store sales are set to disappoint. is this a sign that a reacceleration of a timeless economy may not materialize after all. >> the ceo of sears is stepping down citing family health matters. does the fund manager have enough retail operations experience to man the helm. >> targets has online price matching. is this a new chapter in a bruising retail price war, and of course, what happens to margins now? >> the airlines getting love today. deutsche upped southwest from a buy to hold. others get a downgrade. what is separating the winners from the losers. let's get straight to young brands. those shares are down sharply pre-market. the parent of kfc and taco bell warning earnings for 2012 below wall street forecasts. sales in china falling more than expected in the fourth quarter, down 6%. yum citing a chinese government review of the country's poultry

9:03 am

decline. the last two weeks in december, exactly when that government report came out and raised those questions. that's where they saw the most impact. >> i think they have a small position. thinking about 63, 64 might be a good level. the stock is already down 10%. this was new news. the company was not prepared for a longer problem here. they said it was short term. they're no longer saying that. it could be a six to nine-month head wind. that said, well-run company. kfc has done quite well there. unwilling to panic just because i think they could already have addressed the situation. at the same time, you never want to see a government report saying, be careful, stay away from kfc. it's still been a place where people have felt that they've got the ag seal of approval from the united states. but that seems to be, you kn know -- >> they had already told everybody in china that they had

9:04 am

ceased getting shipments from this particular farm where these chicken samples came from back in the summertime. when mcdonald's addressed the issue, because they were also the subject of this report, they ceased getting shipments from that particular supplier the day before they came out with the statement. but for some reason, yum is feeling a huge impact here. 44% of the 2011 sales came from china. so this is a huge part of revenues. in china, people go to u.s. chains because they view food safety at u.s. chains as better than local brands. >> they have two suppliers lined up. that's one of the reasons why i would think that you could, i don't want to say take a shot, but they come back time and time again. you bet against novak. howard schulz at the 48, 49 level for starbucks. at the same time, yes, it's absolutely true. this is a china play. so you want china to be hitting on all cylinders and not falling double digits. >> amazing this morning how quickly you see a yum, say,

9:05 am

tweet or headline, and how quickly the conversation turns to a nike or other companies who are heavily relying on that country. is the situation comparable or not? >> the last nike quarter looked a little better. north america has been very strong. nike has a new shoe coming out. i think you're absolutely right to worry about anything china. but i think that nike is a two-quarter phenomenon. yum is this quarter, and maybe next quarter or the quarter after. china is the big conundrum. because you have to think, well, wait a second, are they picking on american companies? are they picking on us? >> to what extent does that add the unpredictability of the chinese consumer increasing their spending, the idea that that could be fine, but we have to keep in mind that the government might do things that are unpredictable and not necessarily good for those companies that are outside of china operating? >> i think we got into a groove which said that anything china's good. oh, wow, someone expanding in

9:06 am

china, bf corp expanding in china. now you're saying, it comes with political risk. i'm kind of struck by the fact that there's been a spate of bad news about our companies in china. i want to put two and two together and say, wait a second, don't be as enthused about a chinese initiative in that not everything in china is working out. iron ore, almost return to the material stock. >> they need the materials. >> yes. they need -- that's a very good way to put it. >> not colonel sanders necessarily. >> general cho is finally more powerful than colonel. i know you like general cho. deep fried. >> deep fried. >> extra crispy. >> always. >> you've always stood for

9:07 am

higher cholesterol. >> you know that. the chinese mandate that you have lipitor with your -- >> you need the lipitor. >> now it's generic. >> meantime, sears holdings announcing chief executive is stepping down on february 2nd. family health matters are being cited as the reason. eddie lampert will have the role of ceo. the news coming as the parent of sears and kmart reports a 1.8% drop in same-store sales ending december 29th. all of a sudden the discussion is about lampert himself. we know he's been on the board a lot in the company. is that the same as running stores across the country? >> he's been saying, look, i learned a lot about morgan stanley. i come back to, was he really running the company the whole time? there was a big -- a strategy

9:08 am

developing by ambroseio. obviously there's a founding member who is sick. this is not a kinnard. however, i was gratified to see those sales. they're not down as much as i thought. a rising tide rises all boats, as i told joe. whirlpool, one of the best performing stocks in the s&p 500, if housing continues, lampert will finally be able to explain why he did this to begin with, other than real estate. because remember, the real estate shut down the sales. remember, they got the better of home depot in a previous transaction. so real estate went from positive to negative. and then housing went from a positive to negative. housing comes back. gary bolter, my favorite analyst is saying, it's still overvalued. >> he still thinks it's overvalued. at the end of the day, same-store sales are still coming down. is it a financial story, or is it a -- i mean, do you look at it purely on the basis of what they can generate in terms of

9:09 am

cash flow? he manages for that, the big knock against them is that they cut costs dramatically, underinvested in the stores themselves. they started to look rather shabby. i don't know. sears is just one big conundrum in terms of an investment based on what you're viewing it as a retailer. >> is it best buy with clothing? >> i don't know. >> best buy with clothing? is that a good thing or a bad thing? >> is eddie lampert going to say i'm going to reinvent the retailer. >> the numbers aren't that bad. they're much better than best buy. >> they were quite good. that's where ambroseio was putting a lot of effort into it. there is some traction. >> do you just manage the cash flow and try to continue to shrink the cap in some way? there's always been ulterior motives attributed to mr. lampert, isn't there? not necessarily in the interests

9:10 am

of -- >> i was with someone the other day saying, minnesota vikings were a real estate play. >> that's kind of over. the idea that there's great real estate value there. >> although what happens if the possibility that rents go up dramatically in some of the shopping centers they're in, maybe it turns out to be not that big. although jcpenney, price war, target, price war. maybe the takeaway is retail is too hard right now, including sears, jcpenney, including target and walmart. >> the online component of your sales is increasingly what upgrades, downgrades, all about how ecommerce initiatives they don't expect will pay off as well. >> home depot's ecommerce initiatives have been amazing. there's so many things going on -- home depot, one more thing frank blake has done. let's not forget, housing can do

9:11 am

so -- look at pier 1, how well these have done. anything that spruces up a house, that's already bottomed in price, including a kenmore washer and dryer. not bad. >> no, not bad. >> sears is its own animal in so many ways, including the idea it's a control position of a hedge fund that really should be treated more like a private equity investment in some way. although he's already been paid on the appreciation every year that took place for sears for quite some time. as opposed to private equity where it's only on the exit. it's very interesting. i just don't know that -- >> you've got the hedge fund manager, with the upcoming herbalife meeting. it's funny, if lampert were short sears, would he be telling you, he's not a promotional guy, he's a very quiet guy. i met him when he was 14 at

9:12 am

goldman sachs. eddie's done a remarkable job as a money manager. let's not forget that. >> no, absolutely, auto zone and a number of the other positions have been very strong. >> i think the fact that sears is still alive and kicking is rather remarkable. >> even though it's bleeding slowly. >> does anyone here shop at sears? >> no, but i don't necessarily have the barometer -- >> i don't shop at all. we live in manhattan and it's a different -- >> lets me give you a costco story. one of the single best things, target and sears, i had a bad experience from costco nearby. i got a call from costco on my cell phone saying, listen, i want to know the circumstances of why costco did not treat you well. there are retailers in this country, how great is costco. you're going up against costco

9:13 am

if you're sears. who can compete with costco. >> speaking of competing -- >> let's talk about target and what they're announcing this morning. they're announcing that year round it plans to match prices online of other online companies. it's really upping the ante when it comes to the lowest prices out there. they want shoppers to feel confident that when they go to target, they're going to get the lowest prices. period. that's a huge -- it wins me over. >> i happen to like shopping at target very much. i like to shop at amazon. i like to shop in general, david. we've talked about that. >> i am aware of that, yes. >> now, this is a genuine price war. a very good investor, if you're listening to our dialogue about amazon yesterday, e-mailed me and said, are you guys crazy? amazon, look at the pe, look at the valuation. that actually works in their

9:14 am

favor in a price war. because they almost have an unlimited way to -- unlimited buyer power. remember, this is a company that hasn't been constrained by earnings. so i don't want to be in a price war with them. i don't want to own target. >> you don't? amazon will win. >> everybody loses. >> they said they would be willing to reduce cash flow, which tells the investor that, yeah, they will match those prices and maybe even go lower. they don't care about margins. >> what a terrible enemy to have. >> yeah. >> someone who doesn't care about gross margins. remember u.s. surgical? >> i certainly do. >> suddenly johnson & johnson said we're going to go into this business and cut the margins to -- we're going to come in well under u.s. surgical. because it's still higher than our business's gross margins. people understand at home when you have a competitor that

9:15 am

doesn't care at what price they sell stuff, and you're in the business of trying to meet wall street's estimates, holy cow. we're going to be talking eli lily later today. >> if that ever changes, that dynamic that bezo seems to demand that respect from his investor base, they know that potentially they can turn on the margin switch. if that dynamic ever changes, this may change. but if it doesn't, he's empowered to conceivably compete in a way that -- >> one of the criticisms of the upgrade at morgan stanley yesterday is you're going into an earning season that amazon shows a weakness because they're willing to take a few bullets for a long-term gain. >> amazon, we remember that as being one of the great football price targets during the 1999 period. but people stay home, they shop amazon, people like the ease of amazon. >> yes. >> it is a delightful site. they use this terrific software. the tipco software which says, listen, i saw you liked that

9:16 am

book on general krueger, how about that book on general eisenhower. >> amazing how they know that. >> hey, i'm going to school against amazon and google. >> that's smart right there. >> that's a suma stock. >> record high on amazon yesterday. >> that's the way you do it, right? that, and a better seed. >> we'll get to that a little bit later. >> what a moment. >> as jim said a moment ago, we are going to talk with the chairman and ceo of eli lily later on. set to lose patent protection later this year with cymbalta. and live from ces from las vegas, how the wireless chipmaker is with everything from the cloud to cars. we're back in a couple of minutes.

9:17 am

♪ ♪ ♪ [ male announcer ] some day, your life will flash before your eyes. ♪ make it worth watching. ♪ the new 2013 lexus ls. an entirely new pursuit. ♪ you know my heart burns for you... ♪ i'm up next, but now i'm singing the heartburn blues. hold on, prilosec isn't for fast relief. cue up alka-seltzer. it stops heartburn fast. ♪ oh what a relief it is!

9:19 am

deutsche bank out with a couple of calls on the airlines, upgrading southwest from a buy to a hold. deutsche bank says it feels southwest fresh off a 52-week high is poised to ben git from the acquisition of air tran but sees jetblue's earnings lagging those of its peers. a fire broke out yesterday on an empty 787 dreamliner jet at

9:20 am

boston's logan airport. so the latest in a couple of problems with the new 787. jim, you had just mentioned southwest yesterday, saying you never talk about airlines. but you had to mention southwest. >> sometime, the chart is the best of the airlines that i've seen in a long time. the air tran acquisition, very good. there's so many notes out today, that energy is going down in price. that's always been the variable that no one can control. i think we've all flown planes and would be shocked that, hey, this is an extremely full flight, will you please put your luggage where you can't find it. i do believe southwest, after what i thought was paying too much for air tran, was able to rationalize this. i like the deutsche bank upgrade. >> then it came out. >> thank you. you know, yesterday's phil lebeau report, you watch the stock shrink as you see the

9:21 am

smoke coming. boeing is one of the best-run companies in the world, would i fly this thing. but the technology of a new plane obviously challenged. >> interesting. >> we've had gordon bethune, he calls it a teething problem. which i guess happens with every new model. just rarely on such a public scale, right? this is an operation now. >> you need some gripe water. >> it still works. >> i don't know if you ever used that. that's a way to be able to -- when the kids don't feel well, teething problem. but i will point out, it may be a teething problem, but there's not been a cancellation of orders so to speak. but there was another united air, going to airbus, i've been saying the way to play the aerospace plays, is to go with the united technology. if one wins, and the other loses, it's just safer. >> a couple of points off a 52-week high here.

9:22 am

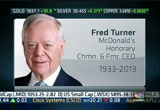

do you switch over to others? >> i agree. there was a little note underneath us, like right there, oh, like a jimmy kimmel thing. it was the most exciting thing to happen in the game last night. we're just way too concerned with the notion that phil lebeau was going to come on and say something negative, because he covers a thing in a way that i feel like, wow, the dreamliner is not ready yet. >> as we go to break, we did want to let you know that a restaurant pioneer has passed away. mcdonald's honorary chairman and former ceo ted turner died yesterday at the age of 80. he was known for shaping the restaurant into what it is today, for the domestic and international expansion plans. in 1958 he wrote the company's first operations and training manual, which is still the blueprint for restaurant

9:23 am

operations today. >> did they talk about him when you did your -- >> he's legend obviously in and out of the mcdonald's circles. served in the role until 1987. remained chairman until 1990. he is survived by three daughters and eight grandchildren. >> wow. i don't spend money on gasoline. i am probably going to the gas station about once a month. last time i was at a gas station was about...i would say... two months ago. i very rarely put gas in my chevy volt. i go to the gas station such a small amount that i forget how to put gas in my car. [ male announcer ] and it's not just these owners giving the volt high praise. volt received the j.d. power and associates appeal award two years in a row. ♪ this is $100,000.

9:24 am

9:25 am

9:26 am

this is the real kickoff, monsanto. latin american sales incredibly strong. this is a biotech company not unlike -- they've got new drugs, new seeds, they are doing everything right. latin america, also the united states, monsanto is just a feel-good story. nothing to do with washington. >> you've liked it for a while. >> yes, i have. >> signer semiville. >> t.j. rogers, a terrific manager. but he's not in apple. being apple is no longer something that you want. i think that's -- i'm being facetious there. samsung reported good numbers. but this is a play on everybody else but apple. they do great touch work. good yield. t.j. saying this is the bottom in a cycle. i'm not going to doubt t.j. i think he's a pretty good guy. >> game stop? >> oh, my. you've got hardware down 2.7%. pre-own, which is always a

9:27 am

terrific -- down 15%. digital, not analog. hardware not selling. i remember when you had to wait in line for the big games. i used to have to wait in line for my kids. now on game stop, it's off the gaming rules. >> nice second half of the year. >> a lot of people felt there was a lot of new product coming out, you'll find new devices. this gaming industry has become challenged. xbox doing well. >> good names to watch. when we come back, an exclusive with morgan stanley's u.s. equity strategist, adam parker is one of the last year's bears, becoming more bullish in 2013. after a strong 2012, what is eli lilly's prescription for profits this year. opening bell coming up in just about three minutes. ] how do you turn an entrepreneur's dream...

9:29 am

9:30 am

9:31 am

the preservation resource center from new orleans rebuilding communities in new orleans and new york from hurricane sandy. celebrating the fifth annual corporate governance awards. right out of the gate, watching apple shares climb 1%. nice move after the past couple of days. there's some reports that tim has made a second trip to china since march. he met with the head of ministry and information technology. >> china, there's a -- we know china, the ipad, ipad mini is selling well. the information on apple is -- there is not a source that doesn't have a view on apple. you find yourself overwhelmed by the data points. which is why i've said own the stock. when i see samsung reporting, and i talk to people and say,

9:32 am

the samsung device outside of the united states is much larger. >> they sold 62 million smartphones in the quarter. apple sold 45 million iphone 5s. they benefited from the supply issues when the iphone 5 launched. >> 500 handsets a second from samsung. the galaxy is now the best selling smart foun, surpassing the 5 and 4-s. >> the mini ipad moving things a little bit. is there something that they have that no one's dreamed of? you go back and look at what they've developed. periodically they've developed what steve jobs used to say is, not what you want in the sense that, well, i'm looking for a better -- but something you never thought about that you suddenly just can't believe you can't live without. i think they've got to come up with something. they've got to come up with something that you can't live without that you don't know

9:33 am

about. >> and they'll be able to do that without steve jobs? not just embracing something, but pushing the people behind it to actually make it a reality? >> tim cook, according to the interview, with steve jobs, not a product guy. but there are product guys there. this was not a one-man company. >> no, it wasn't. >> henry ford was not the only person at ford. but ford did change rather dramatically. is that the right analog? i struggle on apple every day, because the data points are not so great. >> they're not. as a consumer, who uses apple products, we want to love the stock, but that's not necessarily the case. >> i love the ecosystem so much. i was downloading this apple ecosystem from itunes. but it's not a rain forest, and we're not out there trying to preserve it. taking shots at them. >> i'm looking at the european banks. the basel requirements we were

9:34 am

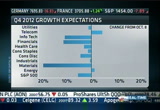

talking about being extended for four years or so. liquidity requirements being loosened. the european banks are doing well for the second straight day. deutsche bank seeing the biggest gain, another 1.5% in today's session. they're well capitalized at this point. >> even during the height of the crisis, the bankers at various places, you say, where would you put your own money if you were worried globally, people would say deutsche bank. it was always solid, even through this problem. obviously they didn't have a -- deutsche bank has german bonds. this is just a case of management being superior to other managements. >> yesterday you said alcoa's conference call would be a road map. we'll see what happens tonight. overall, expectations for earnings have come down since the end of september, somewhere in october. now looking for about 2.4%. even on revenue, i wonder if you

9:35 am

think we have sufficiently lowered the bar. and then also, the quarter's going to include sandy. it's going to include the election. it's going to include the cliff. so there are going to be a flurry of outliers out there. >> i do like that the ceo has never blamed politics for the miss. it's always been the commodity occurrences. those are the question marks. you see iron come up in price, copper get strong. we've not seen aluminum get strong. aerospace a little bit stronger, construction a little bit stronger. remember, they did win the back of the ipad. that is the alcoa back there. they've got new bottles for coca-cola, but they make aluminum. and aluminum is in glut. exciting as the story should be, people get let down. look, i thought -- i talked about monsanto. i was wrong. that didn't come in. i do believe you get a moment to

9:36 am

buy alcoa. it will only be a matter of time. they close factories, smelters in italy, and in spain. can you imagine the political pressure that klaus was under not to close those but he took the tough medicine. one day it will matter, that huge plant in the middle east will matter. alcoa, right now it can wait. >> alcoa can wait. >> there was recently a note about how their balance sheet could be stressed. their balance sheet is fine. that's no reason to sell it. it's the possible commodity in not coming back. i used to think it was a chinese glut. it's not china. china has a lot of flexibility to use aluminum. i believe in this company. i don't know if i believe in the stock. but i certainly wouldn't sell it here, because i think at $8.48, we're starting all over again. >> it almost sounds like you're talking about apple. >> wow. alcoa --

9:37 am

>> apl. >> you said you believe in the company but you don't necessarily believe in the stock. >> i like apple stock. >> exactly. exactly. >> alcoa is not a reasonable multiple. if the glut in aluminum ends the stock in '15, you're betting that the warehouses of aluminum in the midwest, will one day be needed. and we'll find a demand. remember, there are millions of screws in place. that's something that dominates, called fasteners. alcoa is a lowered cost dra patticly. in the end, they're in the aluminum business. >> pushing tin. let's get to bob pisani on the floor of the nyse. >> like yesterday, very modest, down side opening. i know yesterday wasn't terribly exciting in terms of the stock moves. but people should be very cautious here. pay a lot of attention, because right now, the risk is to the downside.

9:38 am

i know yesterday wasn't very exciting, but look where we are right now. at the end of last week, historic highs on the russell 2000. all-time highs on the housing index. airlines were at multi-year highs. the transports were at one and a half-year highs. we're up there in the stratosphere right now. the risk is to the down side, because we've still got the big macro economic environment. there are still plenty of people who think the debt ceiling issues could be a debacle. february 15th, a little earlier than expected, a lot of people floating ideas that moody's might downgrade the u.s. debt sometime this quarter, if there's no grand bargain that ever appears, and that looks increasingly unlikely. i'm in the camp that the risk is to the down side on the stock market right now. earnings today, as you just mentioned here, look, the question has been whether or not putry was the trough in earnings that things would get better from here. it's going to be modest

9:39 am

improvement. q4 isn't looking that great. we're only looking at roughly 3% improvement in earnings. that's not great. top line growth has been nonexistent throughout last year. q3 top line growth was zero. zero. we haven't seen that in a long time. you want to know how weird that is? the ten-year eenaverage is 7%. maybe it will be 3%. that's the hope. it's coming down as we're going in. so we may be at a trough in the third quarter, but the fourth quarter certainly isn't going to be gangbusters right now here. shockingly high, the vix 13.5. i know this is the spot price, it's only reflecting one month out and people don't think we're going to face an imminent fiscal cliff or debt ceiling crisis exactly one month from now, that's why the spot vix is so low. but there are people out there who said to me this morning, it's cheaper to go out and buy

9:40 am

calls on stock than stocks right now. it might be better strategy to just buy calls on a short-term basis. alcoa kicking off earnings season. jim, you mentioned what's going on. i don't know the expectations are very high here. inventory levels are very high. the dollar was weak. aluminum prices barely budged at all in the fourth quarter. obviously this is going to be in 2013 guidance. but right now, they're going to have to be pretty optimistic about things in 2013. i think to move the dial on alcoa. >> you're absolutely right. i know klaus, the ceo, was very optimistic about a bunch of different product lines. but in the end, it's the commodity that is controlling. one day it will be the product lines. great, great analysis. let's head to the bond pits to the cme group in chicago. go ahead, rick. >> jim, it's only been several weeks since there was a lot of intensity regarding, have we started a full-blown bear market

9:41 am

in treasury prices pushing yields up. and as we get basically one week into trading for 2013, it doesn't appear to be aggressive selling. if you look at a 24-hour chart or two-day chart, you can clearly see that we seem to have eased back on some of the selling pressure down a couple of basis points. if you look at 10s minus 2s, the steepening gave you an indication potentially, because short rates are still nailed to the wall based on federal reserve, and where they're keeping their rates, even though the market always wins in the end, it always wins on the long end. so we'll continue to monitor. remember, here we are at 188, the high yield close was 191. the high interday yield was 198. don't hear 2% in there anywhere. there was a lot of traders that were pushing, pressing the market to see what would happen should it breach that very significant psychological level. if we look at foreign exchange, we continue to monitor the

9:42 am

dollar/yen, or any cross trade against the yen. but as you look at this chart of the dollar/yen, we only had one session that closed above 88, that was friday of last week. even though you never challenge a trend this strong, it is a big level as well, just like 2% for 10s. a little profit-taking may be in order. back to you. >> thank you so much, rick. oil pipelines in the energy markets front burners. go ahead, sharon. >> jim, the anticipation of the seaway pipeline, key u.s. pipeline, sending oil prices higher. definitely the u.s. oil price is benefiting from this. we're talking about a pipeline that is carrying crude from curbing, oklahoma, to the gulf coast, and the expansion of the pipeline from 150 barrels per day to 400,000 barrels per day has been widely anticipated. flows could start as early as the end of this week. that is what traders are watching very carefully. that's what all the chatter is in the oil market right now. look what it's done to the spread between brent crude and

9:43 am

wti crude futures. we're at the lowest levels we've seen since september or so. below that $20 mark. we're hovering right around the $18 mark. this is key here. traders say we could see the narrowing of another dollar or two as the seaway gets under way. that is the key pipeline that a lot of traders are watching. that is the key factor that is driving prices right now in the oil market. back to you. >> thank you very much, sharon epperson. coming up next, the eli lily chairman and ceo, why he's so upbeat about 2013. coin star's incoming ceo on how red box plans to stream past archrival netflix. be right back. what are you doing?

9:44 am

nothing. are you stealing our daughter's school supplies and taking them to work? no, i was just looking for my stapler and my... this thing. i save money by using fedex ground and buy my own supplies. that's a great idea. i'm going to go... we got clients in today. [ male announcer ] save on ground shipping at fedex office.

9:45 am

[ male announcer ] save on ground shipping i've always kept my eye on her... but with so much health care noise, i didn't always watch out for myself. with unitedhealthcare, i get personalized information and rewards for addressing my health risks. but she's still going to give me a heart attack. that's health in numbers. unitedhealthcare.

9:46 am

9:47 am

joining us live from the jpmorgan health care conference is eli lilly chairman and ceo, dr. john lechleiter. doctor, thank you for coming on the show. >> my pleasure. good morning. >> okay. first i've got to ask, you're a great american company. and you have done so many things right. yet the emphasis for your company has been, don't worry, we talked about a lot of cliffs on cnbc, don't worry about the patent cliff, the cavalry is coming in diabetes and cancer. why not accept the fact that you had a bad patent cliff and tell people not to worry. in 2014, 2015, you'll be in good shape. >> i think that message is starting to come through. first of all, we've been very successful in driving growth in those areas that are sort of countercyclical through this period. our health business, japan would be another example, and china, among our emerging markets. we're also advancing our

9:48 am

pipeline. we have 13 molecules in late stage development today. we could have as many as five regulatory submissions this year in the u.s. so we're starting to work our way through this patent cliff. our strategy is clearly focused on advancing our pipeline. we're doing a good job controlling costs. we're driving growth in those areas that we have control over. >> doctor, there's confusion this morning. you had a great partnership, a big win for you. and there's a drug that you mentioned in your conference call. it's an insulin drug. terrible, terrible situation with diabetes. just need some clarification. they walked away from a part of your formulation. and they won't be paying you a milestone. why should we not worry about them backing away and what confidence do we have in your diabetes strategy given the fact that they did walk away from a part of your collaboration? >> well, our collaboration is very broad.

9:49 am

it encompasses two of their medicines. one of which we announced yesterday. we intend to file with the fda this year, this would be an oral medicine for type 2 diabetes. two of our insulin products. now, under the terms of our agreement, they were obviously free to make this choice, and the choice they made not to pursue the co-development of one of our basil insulins is based on internal decisions they made about their own product portfolio, which goes way beyond diabetes, and other investments they need to make. while we announced yesterday that we were terminating that part of our partnership with bi, we also announced that we're investing in the final stage of trials for this new long-acting insulin product. so we remain very confident in this product. and we intend now to pursue this alone. we're going to be able to do that with our own means. >> dr. lechleiter, jim mentioned

9:50 am

the patent cliff, i hate to say the word cliff ever again, but unfortunately i have to. you certainly have a deep pipeline. but walk us through the patent ramp, if you will. at what point will new drugs that are approved and on the market actually replace the revenue stream from, let's say, cymbalta? when do we get back to, quote end quote, normal for you. >> we saw the patent cliff coming, as recently as the middle of the last decade began to invest in our pipeline. as recently as 2004, we had a total of seven molecules in phase 2 and face 3, the last stages of testing. today we have almost 35. now, unfortunately, the timing of the launch of the first of those products doesn't precisely coincide with the loss of revenue from our patents. but the guidance we've given is we expect to resume growth after 2014, when we will feel the

9:51 am

brunt of the loss of the cymbalta patent. we're very confident we can achieve that. >> dr. lechleiter, i always felt one of the great things about eli lilly is the dividend. but you've not been able to increase your dividend in the past two years. when we look at drug stocks, we tend to like a rising dividend. when can you go back to the idea that increasing the dividend every year? because you are an aristocrat when it comes to dividends. >> roughly three years ago, but as we go through this period, we'll be very challenged with the loss of several of our patenteded products, that our goal was to maintain the dividend at the current level. that's what we've done. we also announced last month our plans to repurchase $1.5 billion worth of our own shares this year. so our balance sheet is very strong. we're not prepared yet to provide any guidance about changing our dividend. but we want to assure our

9:52 am

investors we're going to maintain that, even through this challenging period. >> you were a leader in alzheimer's research. we've had some disappointments. this is one of the most impossible diseases to tackle. but you're still at it. what are the possibilities that in our lifetime there can be something for alzheimer's? >> i'm actually fairly optimistic about the ability of our industry to come up with medicines that really do slow down the progression of alzheimer's disease. i think we've got some important clues from the expedition studies that we reported out this fall. we announced last month, we're going to go back and do another study focused on mild alzheimer's patients. in the meantime, lilly and other companies have drugs earlier in development that attack the formation much these amalloyd plaques in the brain that lead us ultimately to success. >> well, dr. lechleiter, thank you for what you've done for eli

9:53 am

lilly. >> thank you. >> good to talk to you. good to see you. >> thank you. >> what will it take for second markets to remain relevant in a facebook ipo world? we'll hear from the ceo of the private stock exchange coming up. coming up, there's no doubt this market can erupt. but there are ways we can maintain. one of which is just ahead. six stocks in 60 seconds when "squawk on the street" rirns.

9:56 am

in the next hour of "squawk on the street," we've got big guests. one of the biggest bears on wall street for morgan stanley. we'll talk with the technology behind super high-definition tv. none other than the general, stanley mccrystal will join us live on cnbc. >> we'll get "six in sixty," six stocks in 60 seconds. >> a lot of guys worried about the oil service stocks. oil north going up. chesapeake, look at the troubles. huge driller. i say be careful. the group is undervalued longer term. >> credit suisse rating the target here. >> some people are negative on tech. this one is still working.

9:57 am

>> morgan stanley. >> these guys have put up, there's a series of companies that are doing very well. this is actually a cell phone component doing well. >> itw. >> this is one of the many industrial companies that has had a beginning of the year that's superior. trying to trim everything, i think. >> more bad news for deck. >> i think isi's got the solution. perhaps it's a private equity. bf corp must do an acquisition. tom brady, super bowl? i don't know. >> good question. finally, goldman updates akr. >> these have been great. this one's now cheaper than blackstone. look at it, guys. >> nice timing there. what's on tonight? >> wow, controversy, controversy, controversy. continuing to come out of the jpmorgan. one of my favorite guys, best forming stocks in the nasdaq. putting a shot in your eye.

9:58 am

you can do it far less frequently if you use it for macular degeneration. i don't know, profit taking. and then these guys, they didn't -- biojen is another fabulous company. we were hoping they would have an als franchise for lou gehrig's disease. we need to find out what the next big product is after ms. i love this conference. this is what people want to invest in. don't forget selg. >> you have covered the gamut this week. >> they don't need economic growth to win. >> yeah. we'll see you tonight, jim. nice hour. >> thank you. >> when we come back, adam parker of morgan stanley will give his outlook for the year. ♪

9:59 am

♪ ♪ [ male announcer ] don't just reject convention. drown it out. introducing the all-new 2013 lexus ls f sport. an entirely new pursuit. but don't just listen to me. listen to these happy progressive customers. i plugged in snapshot, and 30 days later, i was saving big on car insurance. with snapshot, i knew what i could save before i switched to progressive. the better i drive, the more i save. i wish our company had something this cool. you're not filming this, are you? aw! camera shy. snapshot from progressive. test-drive snapshot before you switch. visit progressive.com today.

10:01 am

10:02 am

getting more bullish in the new year. adam parker's here to talk about his top ideas for 2013. >> shares of yum taking it on the chin after same-store sales fell more than expected in china. does the parent company of kfc and pizza hut have more room to fall. >> we'll find out what the ceo of broadcom has. >> stanley mccrystal, famous for his role in afghanistan, is here. we'll get his thoughts on the winddown in afghanistan and the "rolling stone" article that cut his career short. >> i want to look at shares of both verizon and vodafone. chairman and ceo is saying buying out the wireless venture, verizon wireless, 55%, 45% vodafone is, quote, feasible. there seems to be nothing new here in terms of mcadams'

10:03 am

comments. we've interviewed him a number of times. in speaking with many people around the situation for years, there has always been a willingness on the part of verizon to consider buying what it doesn't already own, if in fact vodafone were a willing seller. perhaps the idea that mcadams feels they have the financial wherewithal to pull off the deal is perhaps newsworthy. there are no talks going on here, i can tell you. and in fact, nothing really new in those comments. we'll see down the road whether in fact anything occurs. vodafone, last year, received about $3.8 billion in dividends from verizon wireless. it is a very important investment for that company. and seemingly will continue to be into the future. a question of how much in dividends it pays each year is still a key one for vodafone, and for verizon. by the way, verizon ceo is going to be on the "fast money"

10:04 am

halftime report today. a noon interview, first on cnbc, live. he will be from the consumer electronics show. >> meanwhile, james staley, former jpmorgan investment banking chief, is leaving that bank to join blue mountain capital management. also purchased a stake in the hedge fund. kate joins us here on post 9. this is an important left tenant to jamie dimon leaving the bank. >> running the investment baenk, which essentially combines trading and underwriting is the way jpmorgan is structured. it's important to note he actually stepped aside from that job in a slew of management changes that happened this summer after the london whale debacle. staley once considered a possible successor to dimon. but really, they talked about the fact that his age, which is close to jamie dimon's, probably put him out of the running.

10:05 am

they wanted a slightly younger generation. they more or less put together a group of people that seemed to be in the running somewhat for that job, who are all five to ten years younger. i think the departure itself, not a surprise. we knew staley was talking to other parties. but the fact that he's landing here is interesting, because you've got this hedge fund that was wildly successful in 2012. i don't have the exact numbers yet. i know they're north of 10% in terms of performance. they also outsmarted jpmorgan at its own game in terms of taking the other side of the london whale trade during the unwind, and even prior to that, they have put their own bets on to the somewhat illiquid credit. you see that there's sort of a frenimy effect going on. >> dimon praised staley for his years of service. >> absolutely. i think blue mountain wore two hats during the process.

10:06 am

they were a counterparty, so they were looking to make a profit and they did, according to my reporting they made more or less $250 million justn that. were trying to be a friendly counterparty and saying, we know you're in a jam here. what can we do to help. apparently they did actually talk to other counterparties to see what was interested in taking that side. >> what is staley going to do there? this is a $12 billion hedge fund focus on credit. what exactly is going to be his role? he's not, i would assume, going to be investing for that. >> right. i think what he's going to do, david, is essentially help with their growth products. they want to get bigger. they no doubt will add staff, assets. on a wake of a year like this, they should be able it do that with no trouble. staley is sort of known for growing a business. he helped spearhead the deal in 2009. although at the same time, i think we're seeing shrinkage on

10:07 am

the street in general. you saw a departure at citigroup's private bank yesterday, the cio, for example. it raises questions about how large the asset managements will be in the future. >> some of them want to become more institutionalized, get as big as they possibly can, and become alternative asset managers well beyond a pure hedge fund. either take it public or figure out how to monetize their own investments. >> we'll be talking to both staley and andrew feldman, the ceo of blue mountain capital, exclusively at 11:00. >> nice. >> make yourself at home. there's a commissary down the hall. see new a few minutes. back to the markets this morning. one of the more bearish strategists of last year, making calls for 2013. adam parker, from morgan stanley, joins us. always good to have you. good morning. >> happy new year. >> same to you.

10:08 am

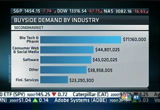

i remember congratulating you on basically naili ining 2011. >> that's kind. the interesting thing, carl, is that in 2011, when we looked at our portfolio, december 30th at 3:00 p.m., 2011, the market traded a forecast on gen-1. in 2012 we outperformed by 280 basis points. i think the reason is the kind of stocks that work in a big uptake, were very atypical. higher quality, larger cap. in 2012 i said we would have a market up mid-teens, you would have picked machinery, well services, so i think that's the interesting dichotomy of coming to great call, bad call. i think the key in 2013 is thinking about the stocks that

10:09 am

outperform independent of the mania. >> big things you're pointing out for this year, get longer china, right? >> yeah. longer china. we added an increased position on two, three months ago to industrials. we think that a lot of negativity is in the market in terms of u.s. stocks with china exposure. some of that's really started to work over the last few weeks, as you guys know. yesterday we decided to increase exposure to semiconductors. to me, that's an economically sensitive business that really hasn't participated in the fund yet. if we did get some sort of economic rebound, there's a chance undershipping and underproducing consumption in the first quarter, that could be kind of a nice risk/reward sector in here. we're also overweight health care. so we continue to believe that a combination of pharmaceuticals and distributions look pretty attractive. i think we're incrementally negative on both the consumer discretionary where you've seen pretty weak results and the financials where we think they had a great run and are probably

10:10 am

due for a pause. >> i'm going to pull you back, adam, to the year-end target that you had for 2012. >> sure. >> it was 1167 on the s&p. >> right. >> you were way off. just simply way off. hundreds of points off the s&p. >> right. >> the reason i bring you back is even now, your target for 2013, i understand, is 1434, which is below where we are at the moment. what is at the heart of your thinking? why do you remain so bearish in these targets even when you were so wrong last year? >> what we have is something called a framework, simon. we forecast the earnings, and we forecast the multiple. and we look at about 19 variables predictors of subsequent earnings. our earnings target's been very spot-on. and so i think the difference has all been in the multiple. if i told you on january 1 last year, we were forecasting the market would be down 3% in our

10:11 am

base case, what we thought was that you would have low growth, as you know the s&p earnings did not grow at all in the third quarter. it looks like from tech and industrials, you won't see big numbers in the first quarter. if i told you on january 1, and i did, it would be hard to tell you there was multiple expansion. the reason you got multiple expansio the basically decided to create trillions of dollars on a computer. >> if you look forward into next year, isn't the likelihood next year is far safer than 2012, and therefore, the multiple will expand again? >> it could. i don't think you can back-test that thesis, simon. it depends on whether you think there will be efficacy to the program, makes the earnings grow better. our view, ultimately you'll get earnings growth. the challenge is we're still way

10:12 am

below consensus. the consensus view is $113 in earnings for the s&p this year. we're at 99. the consensus view is $125 earnings in 2014. we're at 110. we see growth from 100 to 100. the bad news is the consensus numbers have to come way down. i get the tenor of your statement, simon. will you be afraid it could be much worse, euro crisis or debt ceiling or china hard landing, would it really spook you to the point that you get more nervous. nobody's bearish about earnings right now. they aren't. people think it's a -- the numbers are too high and they'll slowly come down, but they're not worried about a recession like they were in the fall, summer and fall of 2011. look, i think the earnings numbers will come down. if the multiple expands, it will be because people believe the policy will be there forever. if you're me, you're worried a little bit more about the fed balance sheet and the fact that it obviously robs from the future to do this unconventional policy. i don't really want to gamble

10:13 am

that is a great long-term strategy. >> we've got to wrap up. i give you a lot of credit. you work for a firm that's got a year's retail platform and probably benefits from people buying stocks. do you ever get pressure from management at all? >> never at all. to be honest, i work at a firm with a bunch of great people. my job is to make people think. when you have a framework for earnings, obviously things don't work perfectly, the market actually ended up below our bull case last year. it was in the range of what we thought was a possible outcome. there's a pretty wide range of things that can happen in any given year. i think good news about being a strategist, david, is you can't be wrong or right about everything. >> no, absolutely. dialogue from the clients and introducing ideas, which you do well at. >> thanks a lot, guys. have a good one. see you soon. >> thanks a lot.

10:14 am

adam parker. certainly one of the leading chipmakers on the market. next on the program, we'll find out what is happening at broad d broadcom when the president and ceo is on cnbc. should we be concerned about the streamliner when a fire broke out on a plane at boston's logan airport.ab t insurance. because what you don't know can hurt you. what if you didn't know that boxes by the curb... make you a target for thieves? or that dog bites account for a third of all home liability claims? what if you didn't know that one in seven drivers is uninsured? and that grease fires have to be smothered? the more you know, the better you can plan for whats ahead. get smarter about your insurance. ♪ we are farmers bum - pa - dum, bum - bum - bum - bum ♪

10:15 am

nothing. are you stealing our daughter's school supplies and taking them to work? no, i was just looking for my stapler and my... this thing. i save money by using fedex ground and buy my own supplies. that's a great idea. i'm going to go... we got clients in today. [ male announcer ] save on ground shipping at fedex office.

10:17 am

of boeing, under pressure again today, as investigators continue looking into what caused a fire at logan airport on a 787 dreamliner parked at the tarmac there. here's the latest in what we understand. the ntsb and boeing, a technical team from boeing, they're investigating the fire on the dreamliner. it was found in a compartment with batteries, and electrical components. it's not entirely clear at this point exactly what caused the fire. it is believed that it might have been caused by one of the lithium batteries on the dreamliner. that is an issue, because the dreamliner uses lithium im batteries to power onboard electronics. way back in 2007 the faa issued special rules for the use of lithium im batteries because of the concern of flammability risk involving those batteries. this is the fourth dreamliner incident involving its electronics, or losing power, since december 4th. look at this timeline. back on november 4th, united

10:18 am

took its first domestic 787 flight, at the time there had been no reports. a month later, a united flight going to niewark to houston, experienced mechanical problems, reporting a loss of power. cutter airways a few days later had to ground one of its 787 jets for what it said was a faulty generator. the 14th of december, united grounded the second of the four dreamliners due to a problem with an electrical panel. and the fire yesterday in boston. as you look at shares of boeing, keep this in mind, we may not have a ruling from the ntsb regarding the cause of this fire anytime soon. but we should pointed out, we have not seen any customers cancel orders with regards to the dreamliner and these problems. they still have a backlog of 800 orders. anytime you have a headline risk like this, that's when you'll see a stock like boeing come under pressure. today, they're down as they look into what happened in boston.

10:19 am

speaking of headline risk, a rough morning for yum investors, after it issued a second sales warning last night. this time, over the negative publicity about the chinese government investigating its antibiotic use for the kfc brand in china. it says sales have been significantly affected. rachel rothman is an analyst at susquehanna. this is particularly difficult for yum as kfc is trading on its reputation as being a western brand that is likely to have higher food standards than its chinese competitors. >> that's correct. i agree with that. >> so how concerned are you now, that you have this second sales warning? what can you see in the company for the last two weeks of december, and what do you fear for january? >> i think the real issue is going to be that in its third quarter earnings release, that took place in the second quarter -- excuse me, the second

10:20 am

week in october, the company had guided positive same-store sales in china. then they came out about six weeks later and told everyone that sales were decidedly softer than they had expected and they were now going to be down 4% in the fourth quarter. and this was obviously before the incident with the suppliers. then on the 21st of december, they came out and they acknowledged the incident with the suppliers. but said there had just been a, quote unquote, moderate impact. more recently, last night they lowered the bar for the fourth quarter again, now down to a 6% decline year over year, and saying that the impact has been significant. so i think the real question is, to what extent is this just a one-time event, and to what extent is this possibly masking overall weakening demand, which has continued to progress throughout the quarter, and what will the implications be for 2013. keep in mind, they had guided to

10:21 am

2013 china same-store sales positive mid-single digits. i think when they report fourth quarter now, they're likely to lower that bar, and investors will probably be cautious about the sales trajectory for china for the balance 2013 going forward. >> rachael, is there any read from mcdonald's? they were also questioned by the fda. they said on december 19th they had stopped deliveries from this particular chicken supplier in china on december 18th. do you think that there's a similar impact on mcdonald's at all, or that even perhaps at the margin, they will miss same-store sales numbers because of what we're seeing at yum? >> i think you bring up a good point, which is that this in some sense is truly a supplier issue. it is impacting yum. but it isn't that yum had the issue, it's that two of its suppliers had the issue. if i were to make a guess about

10:22 am

what the impact would be for mcdonald's or yum, i think it would be stronger for yum in the fact that kfc is identified as a chicken brand, where mcdonald's is not necessarily as closely tied to chicken, even in china, as yum is. so i think it's if the consumer is concerned about chicken products in general, i think it would paint yum with a stronger brush than mcdonald's. >> we've got to let you go, but before we do that, you've lowered your price target to 65, which is where we kind of are with the stock at the moment. we were at 74. so is the correction essentially enough, is it factored in? >> it's only enough if comps can reaccelerate and be positive for 2013. >> okay. we'll leave it there, rachael. thank you very much. rachael rothman at susquehanna. >> thank you. the key chip suppliers in the smartphone and tablet markets today. the president and ceo lays out what's new for 2013. we're back in a minute. from cap, thor gets great rewards for his small business!

10:23 am

your boa! [ garth ] thor's small business earns double miles on every purchase, every day! ahh, the new fabrics. put it on my spark card. ow. [ garth ] why settle for less? the spiked heels are working. wait! [ garth ] great businesses deserve great rewards. [ male announcer ] the spark business card from capital one. choose unlimited rewards with double miles or 2% cash back on every purchase, every day! what's in your wallet? [ cheers and applause ] she keeps you guessing.

10:24 am

it's part of what you love about her. but your erectile dysfunction - you know, that could be a question of blood flow. cialis tadalafil for daily use helps you be ready anytime the moment's right. you can be more confident in your ability to be ready. and the same cialis is the only daily ed tablet approved to treat ed and symptoms of bph, like needing to go frequently or urgently. tell your doctor about all your medical conditions and medications, and ask if your heart is healthy enough for sexual activity. do not take cialis if you take nitrates for chest pain, as this may cause an unsafe drop in blood pressure. do not drink alcohol in excess with cialis. side effects may include headache, upset stomach, delayed backache or muscle ache. to avoidg-te seek immediate medical help for an erection lasting more than four hours. if you have any sudden decrease or loss in hearing or vision, or if you have any allergic reactions such as rash, hives, swelling of the lips, tongue or throat,

10:25 am

10:26 am

of all u.s. and international forces in afghanistan, a career who came to an abrupt end in many ways following a "rolling stone" article. he's been off the radar since his resignation about three years ago, until now. his just released memoir "my share of the task" in which he details his role in the leadership he picked up along the way. the early days at west point, in reading about it, you didn't even think you would make it. you did things we all did as freshmen in college. different at west point. but you were surprised when you actually were considered as a leader in your own right. why was that? why were you seen as somebody who might rise through the ranks? >> it's interesting. i had a leader, after two years at west point, my rocky two years, who pointed out that my peers thought highly of me. and the things that he thought indicated real leadership, not my misbehavior, were more important. he brought me in and simply

10:27 am

said, i believe in you. you're going to be a great leader. it had an amazing effect on me. somebody telling me, instead of them telling me all the things i had done wrong, he simply said, you're going to be a great army officer. in some ways i think he raised my personal expectations. >> you know, you are known as somebody who was well regarded by your peers, and by those who worked for you. i wonder, though, so many other people who watch our program right now, are leaders in their own right, or want to be. what advice do you give them in terms of managing up? because that part of your career may not have gone as well as perhaps you'd hoped. >> it's always challenging, david. what i would say is, the first most important thing is trust. and building relationships and trust takes time. it's not something you simply say, i trust you. there has to be a history of exchanges, there's got to be a history of credible actions. i think up and down chains of command or layers in an organization take a lot more time than people think. it needs to be a focused effort,

10:28 am

not a by-product. ren, insign said, if i had a tough problem i would spend 15 minutes understanding it and five minutes solving it. i think you need to spend the special hour building teamwork and relationships, and all the rest of the problems are easy to solve. >> what about breaking bad news. some look back at your career and criticize the fact in the early stages of the insurgents, you backed up your boss, then secretary of defense donald rumsfeld, who said stuff happens. you were saying similar things at that point. did you know better? did you believe that? and what about saying to your boss, hey, you're not getting this right? >> there's a very fine line. i think in an organization you've got to be extraordinarily candid to your bosses. but at a certain point when a decision is made and a course of action has been selected for any organization, people have got to support their leaders. and it's important for people inside the organization and outside the organization. i don't think it's dishonesty.

10:29 am

i think it's when the team goes to the huddle and the quarterback calls a play, whether everybody would have called the same play doesn't matter. they have to run the same play. >> you've got to get in line, be a good soldier, so to speak. >> that's right. >> in washington we talk about what seems to be a lack of leadership, particularly on this program we talk so often about the fiscal cliff, and now the debt ceiling debate coming. do you agree, is there a lack of leadership there, and conceivably what can be done to change that? >> i think what we've got is an organization, leaders in washington, who have lost sight of what their mission is. their mission is to serve the american people to get certain key things done. budgets passed, agreements done. and i think that people have got to understand the greater good is more important than the individual gain that they might make, posturing, or whatever. i think it's a real problem. >> as part of what may end up being yet again another potential compromise, we may see spending cuts significantly for the defense budget. do you think it can handle that,

10:30 am

what you've seen in afghanistan and iraq as well, that we can cut defense spending meaningfully? >> i think every part of the u.s. budget is going to be cut. i think defense should or will not be exempt from that. it forces tough choices. but that's what leadership's about. it's setting priorities. and that means we're going to accept some risk. but as long as everybody understands the risks, then i think it's the right thing to do. >> we're roughly two years from the timetable set by president obama to withdraw our forces from afghanistan. today, another unfortunate story about an afghan soldier, firing on and killing some nato forces, not u.s., i don't believe. many people look at that and say, why don't we get out now, it's not going to work. it's not going to succeed. do you agree? >> i think afghanistan can succeed. but i also think it's important for our country on two levels. first, we do have an emotional commitment to afghanistan, a responsibility. we went there in 2001 for our interests, to go after al qaeda.

10:31 am

not because the afghans asked us. and we raised expectations among females and other parts of society. so i think there's an emotional commitment. but there's also a geostrategic imperative. stability in that region is important for the world. it's important for america. hundreds of thousands of eep soldiers there. >> how could we hope for stability if we're out entirely in two years and the taliban knows we're going to be out? and even with 70,000 troops on the ground right now, is that really possible? >> i think we've grown afghan capability a lot. but they've got to step up and actually use it. i think what president obama has offered is a strategic partnership. president karzai will be here this week in d.c. visiting president obama, and i suspect they'll be talking about something that is a durable, long-term, sustainable relationship which allows us to help without allowing us to do too much. >> have you seen the movie "zero dark thirty" yet? >> i have.

10:32 am

i think the depiction of the raid really captures -- i went on about 150 similar raids. it's real in tenor and tone. the second is, they show a decade-long effort by hundreds of thousands of professionals day after day, year after year, despite sacrifices. i think it captures that well. >> you were part of that, and we certainly appreciate your service. >> david, thanks for having me. >> i read your book and very much enjoyed it, his new book called "my share of the task." >> thanks a lot, david. movie streaming brought to the dvd kiosks. could the new announcementing a netflix killer. [ male announcer ] where do you turn for legal matters?

10:33 am

at legalzoom, we've created a better place to handle your legal needs. maybe you have questions about incorporating a business you'd like to start. or questions about protecting your family with a will or living trust. and you'd like to find the right attorney to help guide you along, answer any questions and offer advice. with an "a" rating from the better business bureau legalzoom helps you get personalized and affordable legal protection. in most states, a legal plan attorney is available with every personalized document to answer any questions. get started at legalzoom.com today. and now you're protected.

10:35 am

a little over an hour into trade. this is "squawk on the street." 7:34 on the west coast, 10:34 on wall street. monsanto rising 3% on better than expected quarterly earnings. indeed, an upbeat for year guidance. celgene and gillead sciences is hitting an all-time high. they're blaming infighting over the fiscal cliff for an industry slowdown of the end of last

10:36 am

year. the global business travel association says spending by u.s. companies rising 1.6% last year. that's worrying, because companies invest in business travel when they want to drive their top line growth. and that effect may show up later down 9 line. the coo said a timely resolution to the debt ceiling, with that spending, could reaccelerate with the full year pushing up to 4.6%. >> largely, business travels has been in a holding pattern, has been in the latter half of 2012. and most likely will be for the first half of this year. but if we start to see some more of that confidence resume, companies will, cfos w begin to release the budgets that they've planned for business travel to really start pushing the pedal on the gas to grow the economy again. >> moving on here, as the

10:37 am

streaming wars heat up between amazon and netflix, red box offering a monthly rental plan under the name red box instant. we're joined now from ces in las vegas. julia? >> thanks so much, melissa. scott, thanks so much for talking to us today. >> glad to be here. >> redbox instant by verizon, you're coming into a very crowded landscape, with some very established players with deep pockets. how will you compete? >> we're going to compete by really doing what we always do, focus on the consumer. we have a great consumer base with redbox and we'll match that up with what we have with verizon, and we're going to bring movies that matter to the marketplace. we have a great offering with both four nights at the kiosk, for new release content, as well as great unlimited streaming. we're very excited about the offering and very excited about how, in our public data, people are reacting to it. >> just yesterday we saw netflix

10:38 am

secure more exclusive premium content. is this going to be a problem when it comes to nailing down top share contents? >> i think we'll continue to get great content. one reason we partner with verizon is their great access to content and our ability to bring that to our consumers. we're very confident we'll be able to go forward and bring great offerings. so far, people are believing us. >> you're incoming ceo. you've been cfo the past few years. >> we'll stay focused on the strategy over the last three years, which is focusing on the consumer, bringing great offerings that are simple, easy, and convenient. and really, about driving after that automated retail space, which is $1 trillion space. we think we have a lot of opportunity to bring great solutions to the marketplace. >> our viewers are probably most familiar with the redbox kiosks. is there a limited growth for those? are people just switching to all the streaming possibilities that you see here? >> there's still great growth with the dvds.

10:39 am

in fact, this year it's over a $5.5 billion market. we see it extending out over quite some time. we think there's a great opportunity to keef leveraging to over 42,000 kiosks we have. but we're not sitting on our hands. we certainly are with the redbox instant by verizon bringing a great streaming offering into the marketplace. we recently launched in two test markets, one test market, the ticket business, where people will be able to buy great tickets to great events and pay only a $1 service fee. >> melissa? >> hey, scott, melissa lee. i've got a question for you. there was a lot of investor unease when it came to the ceo transition. i'm sure a lot of people out there will feel comforted to hear you say you're sticking with the strategy from the past three years. one of the major criticisms is per-share earnings strength was driven by lower costs as well as tax benefits from red box as opposed to organic growth. what can you tell investors

10:40 am

about ramping up organic growth as the stock has seen about a 30% decline in the past six months? >> we're certainly going to be focused on our core businesses. with coinstar machines, we're making investments in moving out with the product with paypal on our coin machines. we'll continue to make great investments with redbox, whether it be redbox instant or tickets business. we have new ventures that actually -- six new ventures we're bringing to the market. one is coffee, which we'll launch in the thousands of kiosks later this year. and so we really think that being able to continue to focus on bringing great automated retail solutions into places where our consumers are going day in, day out, will certainly help us grow the business. we're focused on doubling the size of this company over the next five years and we think we have the strategy in place to do that. >> you mentioned automated coffee. doubling the size of the company, what other methods are you aiming for specifically, scott? >> i think from our core

10:41 am

businesses, we expect half of that to come from the core business and half to come from our new ventures. some of the new ventures, there may be acquisition opportunities there. we're continuing to evaluate that, and again, we have a lot of confidence in our ability to continue to drive the business, both the top line as well as the bottom line which is really important. >> you mentioned automated coffee kiosks. launching thousands of kiosks in the next year, that seems like a risky bet in a world where people are accustomed to, say, starbucks, which is a different level of service and perhaps quality of coffee. >> we have well over 100 kiosks under the seattle's best brand, and they're working out great. people love the value and convenience of it, to be able to go into the grocery store, pay $1 for a 12-ounce cup of coffee or $1.50 for a latte. it's individually brewed. not your typical coffee out of a

10:42 am

kiosk, but what you would get out of a normal coffee stand. >> i know you're also testing electronics, because people are starting to think of things like movies, which as something you get via streaming and not from a dvd anymore. >> we really think this automated retail space, what we really tried to do is bridge that space between the bricks and mortars. what people want is the mega transport, urbanization, and the like, people want instant gratification. they want access to products. and it needs to be in a smaller footprint. we think being able to bring things like coffee, great value electronics, whether star studio we have in the malls, or healthy prepared foods, all of those things address what the consumers are asking for. we feel very good about that. >> scott di valerio, thank you so much for joining us. >> thanks, julia. >> julia, thank you very much for that. market flash here. sue? >> hi, carl. thanks very much.

10:43 am

we're focusing on gamestop right now, which is really getting slammed in today's trading session. they did not have a good christmas season. sales down better than 4%, almost 4.5%. after closing 200 stores in november. you can see the percentage loss today, about 6.5%. it's not a pretty chart. there's also been controversy, of course, about the video game business and violence in video games. and that was the one area of weakness for them. internationally, they did better than they did domestically. they had very light foot traffic during the holiday season. back to you guys. >> thanks so much, sue. changing the guard again at sears. sending shares down about 7% this morning. financier eddie lampert back in the driver's seat. can he keep the turn-around plan on track. we're back in a couple of minutes.

10:44 am

10:45 am

[ male announcer ] how do you turn an entrepreneur's dream... ♪ into a scooter that talks to the cloud? ♪ or turn 30-million artifacts... ♪ into a high-tech masterpiece? ♪ whatever your business challenge, dell has the technology and services to help you solve it. to volunteer to help those in need. when a twinge of back pain surprises him. morning starts in high spirits, but there's a growing pain in his lower back. as lines grow longer, his pain continues to linger. but after a long day of helping others, he gets some helpful advice. just two aleve have the strength to keep back pain away all day. today, jason chose aleve. just two pills for all day pain relief. try aleve d for strong, all day long sinus and headache relief.

10:46 am

i can't see how anyone could be confident in our country, in our political leaders, if we default on our debt. >> we're going to hit that debt ceiling u maybe even sooner than we thought. >> even if it's delayed by a week, this looks like we're dysfunctional, which we are. >> it's really tough stuff to have a partial government shutdown. we should not tid dl around with the full faith and credit of the u.s. government. big news at sears today. the company announcing ceo lewis ambrosia will step down early next month, citing family health reasons.

10:47 am

eddie lampert will assume the role. we have more on this move, and whether or not lampert has already been doing the job to some degree. >> he has. obviously they own over 50% of sears. it appears now he has his hands a little bit full. he's taking the reins officially, talking strategy for his group, as well as sears, not to mention having just moved his firm to miami for tax reasons, and having to replace the top guy in that process. his new right-hand man who will run the day-to-day operations at the firm is a guy that is familiar, the interim leader at best buy. he was passed over for the job at best buy and announced late on new year's eve he would head to miami as president of esl. in the release lampert said, mike's background fits with our strategy and he will be a great asset to our company. remember the portfolio includes many retailers. in the weeks leading up to his

10:48 am

appointment, i spoke to people around this story, including investors who said that they were questioning mikan's background in the retail sector. i got a tip about the story, and a lot of people said he's not the guy, he doesn't have the right background. remember, he was the cfo of united health group, even though he was on the board of the struggling retailer for about four years, i think people are questioning, is he the guy for esl when they really need a savior here. >> i think it depends on what your strategy is. barron's said it was to have a liquidation of sears. is that effectively what we're seeing? more assets were sold in october. >> mikans' background is in operating leverage and making sure that the financial house is in order. that's what he was doing at united health. with everything else in esl's portfolio, it is about sears, but it's not about sears. what are you doing with auto zone, at gap, which is a

10:49 am